Protect your health

worldwide, with

Cigna Global

Individual healthcare to suit your needs

Get a quoteAbout Cigna

Established over 225 years ago, Cigna is a globally recognized and trusted health services provider, with 180 million customer and patient relationships worldwide in over 200 countries.

They specialize in international health insurance for globally mobile individuals, providing healthcare coverage, well-being services and international travel support.

Whether you are an expat working or living abroad, someone who has retired to a different country or a student perhaps, their medical plans can be tailored to suit your needs, wherever your adventure takes you.

Why choose Cigna?

Global Network

A truly global network of over 1.65 million hospitals, clinics and medical professionals

Digital Tools

A suite of digital tools, including Global Telehealth to manage your health and well-being anytime, anywhere

24/7 Support

Multi-lingual Customer Care Team available 24/7, 365 days a year

How to create your plan

Creating a comprehensive, tailored plan with Cigna is simple.

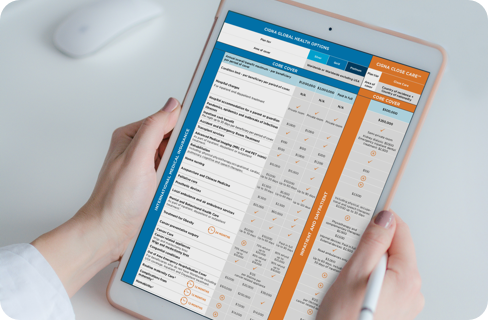

Select your core plan – International Medical Insurance

International Medical Insurance is your essential cover for inpatient, outpatient and accommodation costs, as well as cover for cancer, mental health care and much more.

Choose from two areas of coverage: Worldwide including USA or Worldwide excluding USA.

Cigna Close Care

Only looking for cover in two countries - your country of residence and your county of nationality?

Enhance your protection with optional modules:

International Outpatient

More extensive outpatient care for treatments that don't require an overnight stay in hospital. Including prescribed outpatient drugs and dressings and much more.

International Medical Evacuation

Medical evacuation in the event that treatment is not available locally in an emergency, as well as repatriation, allowing you to return to their country of habitual residence or nationality.

International Health & Well-being

Proactively manage your own health. Screen against disease, test against common illnesses and get reassurance with routine physical exams.

International Vision & Dental

Vision care including an eye test and a wide range of preventative, routine and major dental treatments.